Deep Web Value: $HCP

HashiCorp

Welcome to Deep Web Value #2. I hope you all have been well since my last post and have been navigating the recent volatility favorably. In this edition we will be digging into HashiCorp ($HCP).

About the format. I believe that a successful retail investor needs to deeply understand business, find strong companies, and hold. I judge companies based on 10 questions:

What is the problem they are solving

How are they solving it

What is their market

Who’s the competition

Whats the business model

What do they need to be successful

Who’s on the team

Whats the culture

Whats the vision

How are they performing

HashiCorp

Most well known for being the creators of Terraform, HashiCorp was born in the wake of the cloud renaissance. The cloud solves a lot of problems but it doesn’t solve provisioning and configuring computing equipment, it instead translates it from a physical to digital problem. HashiCorp makes software products for IT practitioners that make creating and delivering solutions in the cloud faster and more efficient.

Cloud platforms like AWS, Azure, and GCP have revolutionized doing business online. This digital renaissance comes with enormous opportunity, but also a new market for managing the problems created by outsourcing computing infrastructure.

One challenge that comes along with adopting the cloud is provisioning the resources you need. If you were building your own infrastructure you would order hardware, software licenses, and networking equipment to meet your needs. With Infrastructure as a service (IaaS) you tell the cloud platform what you want and configure it using their web interfaces. This takes a different skillset, administrators need to be well versed in the cloud platforms terminology and interface, as well as common hardware, and networking knowledge. It becomes more complicated when you have multiple platforms which have their own terminology, and interfaces.

Moving to the cloud presents another problem, security. When everything is on premises you don’t need send precious secrets across the web because its all internal, with the cloud you’re now passing sensitive information over the web, and that needs to be protected.

These new challenges become a market in the wake of the cloud renaissance. HashiCorp offers several products that make orchestrating infrastructure running in the cloud scalable, repeatable, secure and in some cases automated. This way, as a business you take advantage of the cloud, and also minimize the work load that comes with it.

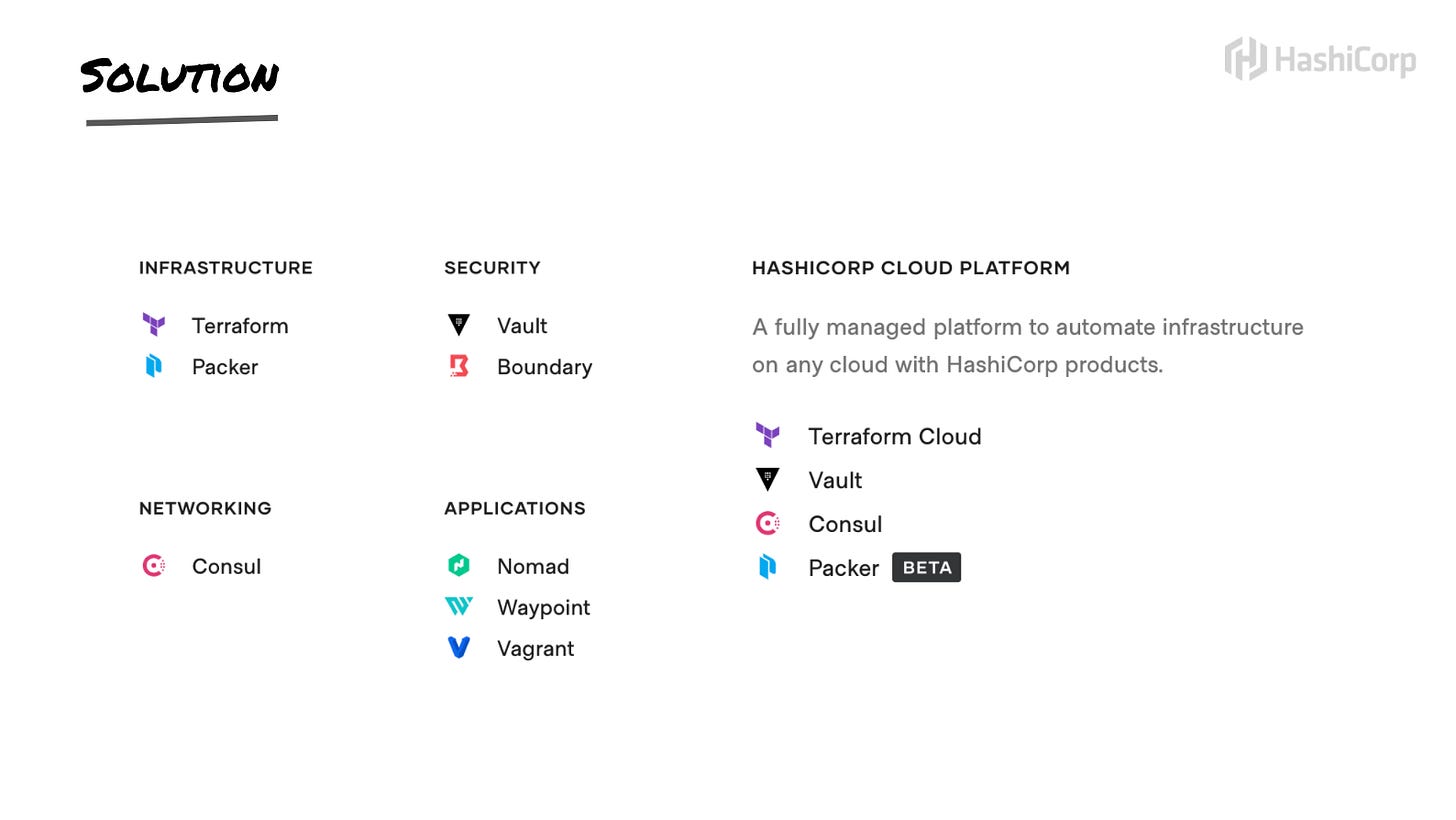

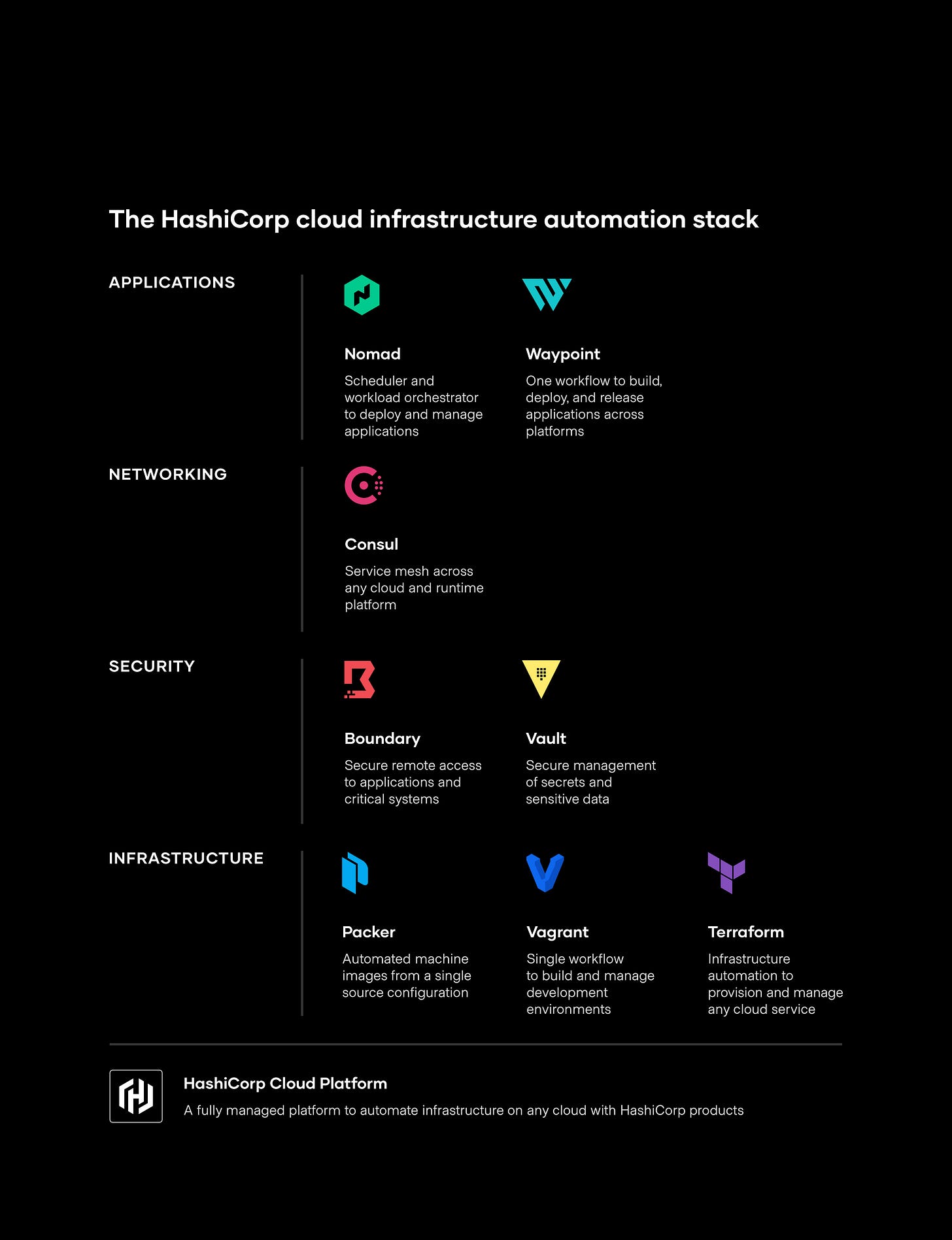

HashiCorp’s commercial products make adopting the cloud more manageable. Existing procedures are often linear, and specific to a given deployment or platform. HashiCorp creates a competitive edge by offering products that scale, and function across multiple platforms. This allows organizations to move faster in the cloud. The core products are Terraform, Vault, Consul, and Nomad.

HashiCorp is probably most well known for creating Terraform, an infrastructure provisioning tool. Simply put Terraform allows you to script the resources and configuration needed to run in the cloud. This helps solve the problem of provisioning digital resources by arming administrators with one interface that works across multiple cloud platforms.

You may have heard of Zero Trust Architecture, this is a growing trend in cyber security. Traditionally networks are connected to everything, and try to filter out bad things. Zero Trust Architecture inverts this. A network begins connected to nothing, and good things are explicitly added. HashiCorp’s Vault, and Consul help implement Zero Trust in the cloud.

Packer, Vagrent, Boundary, and Nomad round out the product suite. These can be used individually or all together.

HashiCorp doesn’t just work with could platforms, they also offer HashiCorp Cloud Platform (HCP), a fully managed system to address skill gaps. HCP has a gestalt effect by incorporating all of its products in the same ecosystem.

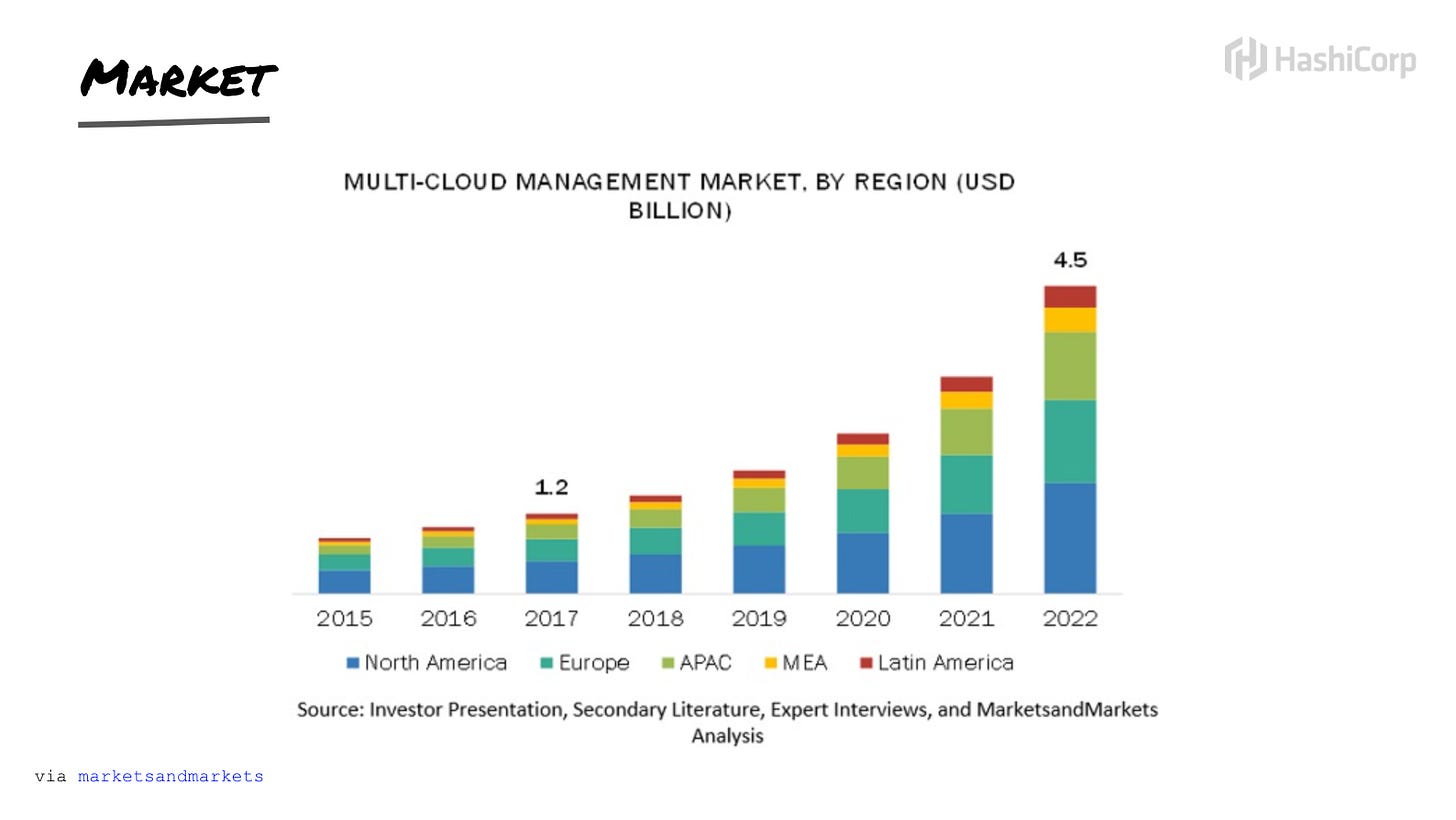

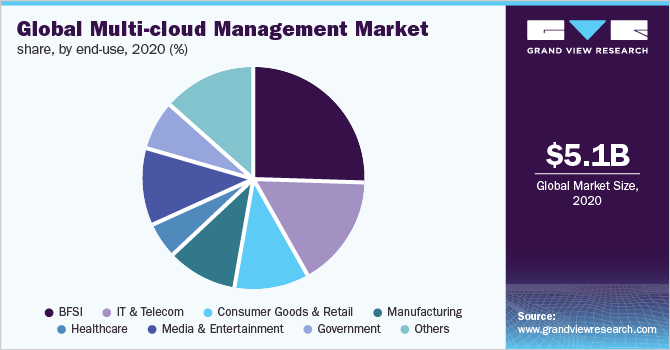

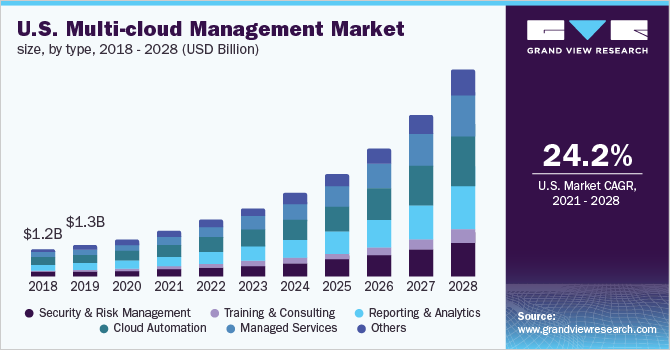

This market consists of organizations shifting computing infrastructure into the cloud, and modern startups that often go to the cloud first. According to International Data Corporation (IDC), the global public cloud services market is expected to increase from $307.9B in 2020 to $704.1B in 2024, a 128.6% increase. The multi-cloud management market is expected to reach $32.75B by 2028, according to a study by Grand View Research, Inc.

HashiCorp targets organizations that choose to utilize more than one cloud provider. Using a hybrid of cloud platforms increases complexity and adds new challenges. According to Gartner that’s 75% of the cloud market. Using the IDC data that’s $230B in 2020, and an estimated $528B in 2024. HashiCorp’s value proposition is the interoperability of its products, which make managing these systems more efficient.

“Growing concerns over the reliability of single cloud are also anticipated to play a decisive role in driving the adoption of multi-cloud management solutions.” - Grand View Research Inc

According to market size based on this report and reported sales, HashiCorp accounted for 3.6% of the market in 2020, and 5.1% of the market in 2021.

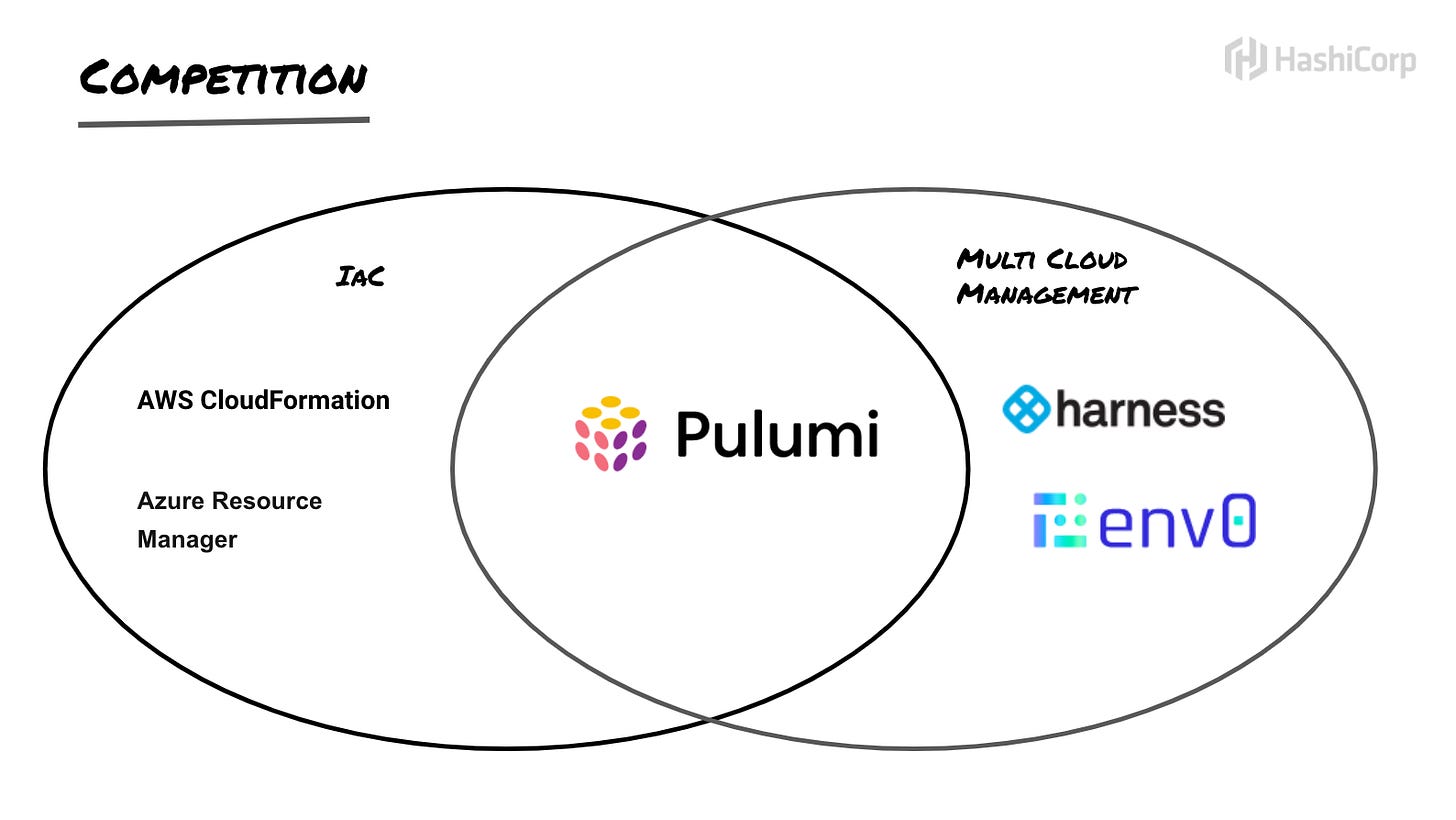

Terraform, and Vault combine to account for 85% of HashiCorps revenue, so I’m evaluating competition based on these offerings. In the case of Terraform Infrastructure as Code (IaC) is a new technology born out of the cloud migration trend so there aren’t many alternatives especially independent of cloud service providers (CSPs).

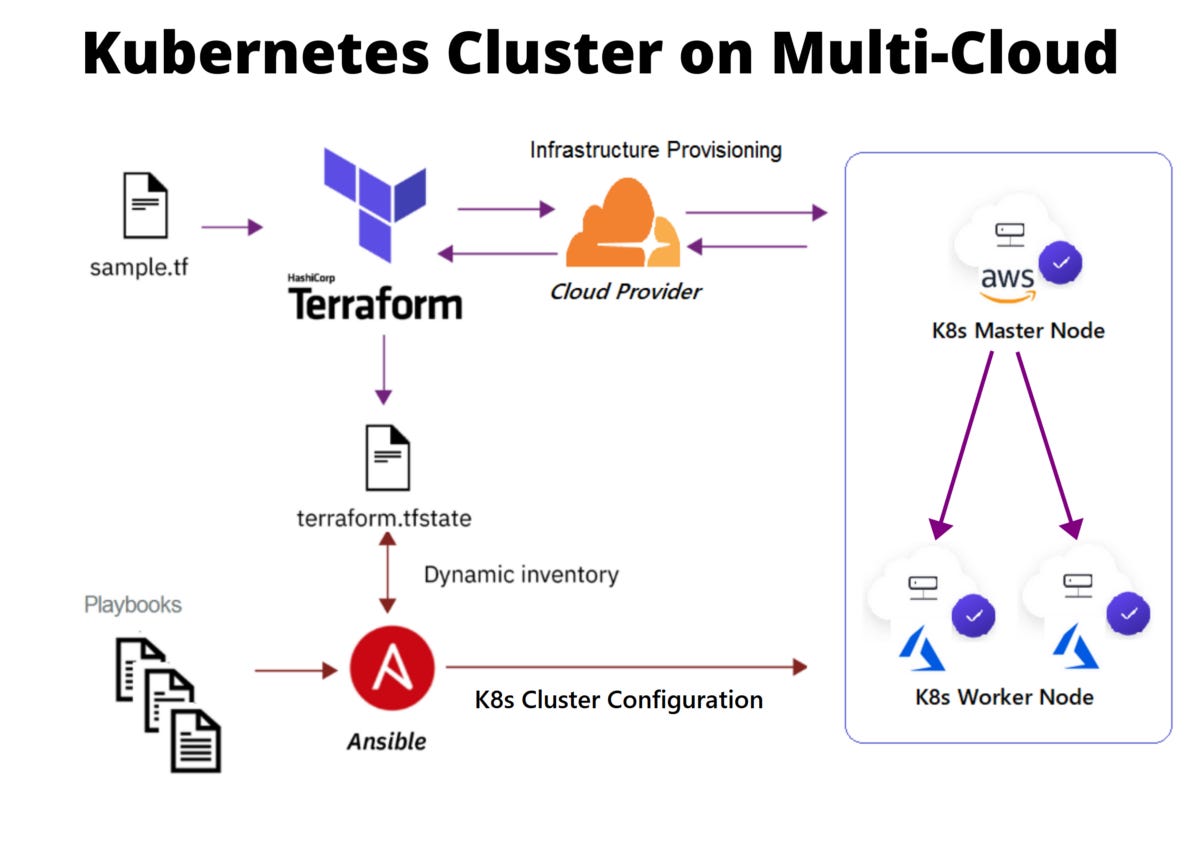

First if you’re not familiar with IaC it’s important to understand what it is not. IaC enables provisioning, and configuring cloud resources as code, not managing those resources once they have been provisioned. Googles open source tool Kubernetes is often mentioned along side Terraform but it is not a replacement for IaC but a supplemental tool. Another tool that is adjacent but not a direct competitor is Red Hats Ansible. Although Ansible is capable of provisioning cloud resources it is not as robust as Terraform is and is stronger on the configuration management end of things. Terraform can be used in conjunction with both to complete the cloud automation journey. A typical use case for this would be to use an IaC tool like Terraform to first do the provisioning and initial configuration. Then Kubernetes to manage containers in action, and Ansible to make configuration changes to the already deployed system.

Now with the understanding of where IaC fits into the Cloud deployment model we can identify Terraforms direct competitors. Cloud Service Providers (CSPs) often provide their own IaC tool, like CloudFormation from AWS, and Azure Resource Templates. These tools are not as mature as the independent solutions. CSPs have a conflict of interest in this market because they want cloud customers using their services exclusively. For example CloudFormation does not support provisioning resources in Azure or GCP. On top of not supporting other cloud providers these tools, they’re not as fully featured. Terraform has better support for scalability, modules allow you to reuse resources. Terraform also has a thriving community of open source developers that extend and contribute to the tool.

One advantage the CSPs have is that they are faster to adapt to their own changes, for example if AWS comes out with a new service it’s likely going to be supported by CloudFormation before Terraform. The benefits of the CSPs IaC tool really make sense when you have a single cloud provider, and have a relatively simple resource architecture. Because of the conflict of interest for CSPs the IaC market is insulated, leaving the door open for tools like Terraform to thrive.

In the previous edition of Deep Web Value, we explored Elastics competitors. Being that both Elastic and HashiCorp have similar business models with a strong focus on Open Source, could HashiCorp face the same challenges that Elastic has battling these cloud giants?

Currently Terraform is distributed under the Mozilla Public License v2.0, which does not prevent other organizations from monetizing the source code. Elastic ran into this problem when Amazon decided to offer an ElasticSearch service in AWS. In response to this Elastic moved to a dual license approach preventing this. The fact that HashiCorps target target market is organizations using multiple CSPs, I think protects them from this possibility. CSPs have a conflict of interest in offering Multi-Cloud support. The cloud service market is ~10X the Multi-Cloud management market value. It’s in the CSPs best interest to not compete in the Multi-Cloud Market.

Being shielded from the CSPs is good, but there is nothing preventing an organization from building on top of HCPs open source products and monetizing. HCP will have to compete with copy cats in this space like harness.io and env0.com which offer IaC as a service, Terraform Cloud like solutions. Building on top of an OSS and monetizing is a double edged sword, on one hand you don’t need to spend the resources to develop your own solution, but on the other hand you will always be a step behind the OSS maintainer, and the maintainer will always be viewed as the experts.

This brings us to other Multi-Cloud IaC projects. In this space, at this time there is only one other major product, Pulumi. Pulumi was founded in 2017, and is a direct competitor to Terraform.

Terraform has a 3 year head start on the market, founded in 2014, and prides itself on being the choice of practitioners. When looking at Github, HashiCorp’s strategy seems to be working. Terraform has 31K Github stars, 1.4K issues and 29K commits compared to Pulumi’s 11K Github stars, 1.3K issues and 6.6K commits. Issue numbers look relatively equal but when considering the age, and sizes ~191Mb vs Pulumi ~49.Mb Terraform has fewer issues per lines of code.

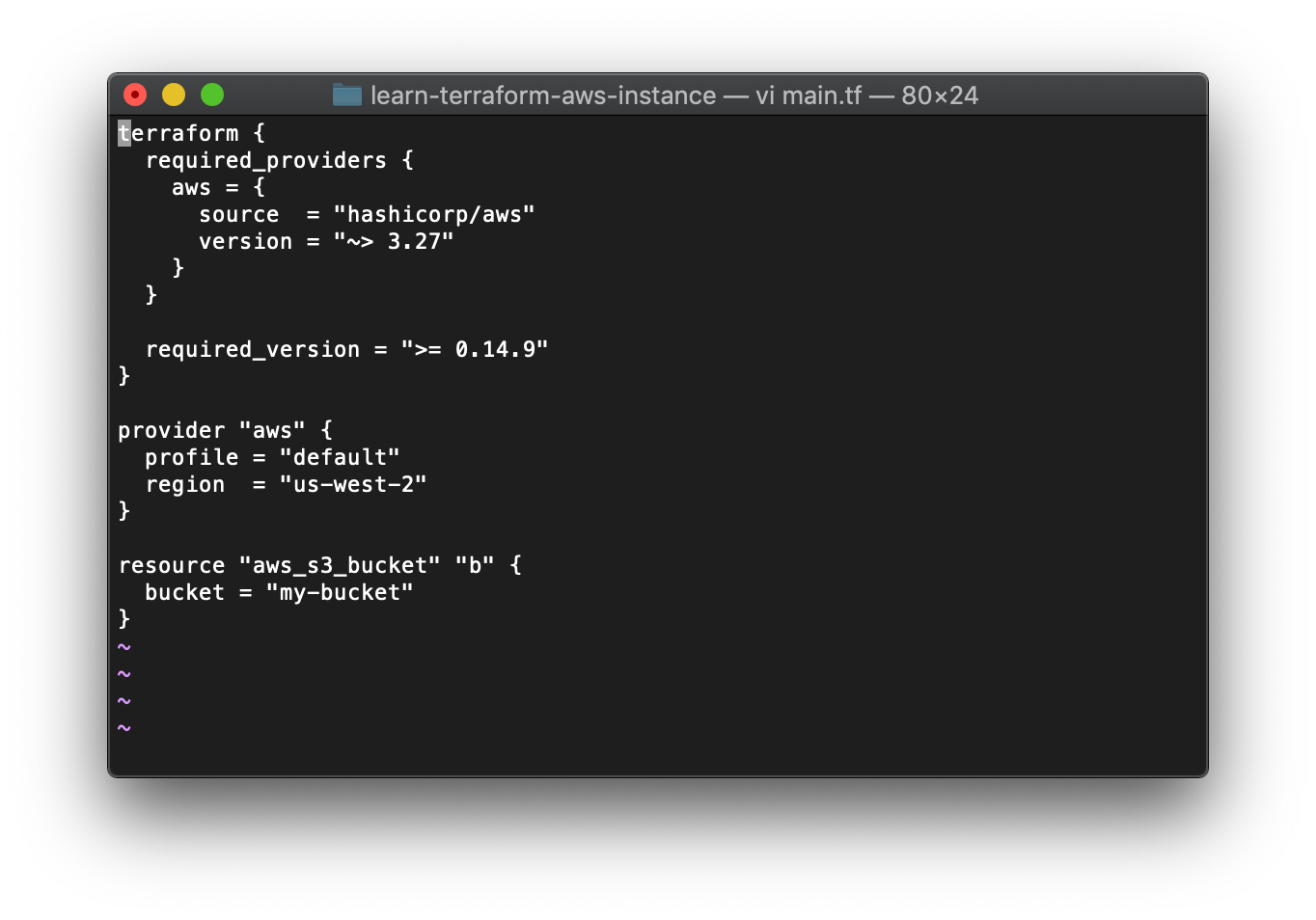

As a developer I wanted to get a feel for each technology and decide which I would personally prefer. First I followed the Pulumi “Getting Started” guide for my language of choice Javascript with my AWS account, and on my MacBook. Getting started with Pulumi felt very natural as a developer, I didn’t need to configure anything for AWS because it uses environment variables which I already had set up for other projects. Installing Pulumi was straight forward using Homebrew. Then editing the code to create a new AWS S3 bucket felt comfortable. Then running the code to provision my new bucket was as simple as “pulumi apply”. All in all it took about ten minutes.

I then used Terraform to achieve the same result. Following the documentation installing Terraform was simple, the process was similar with the exception of setting up credentials and writing the code to provision a new bucket. To authenticate my AWS account I had to install the AWS CLI and add my credentials. Terraform uses its own language HashiCorp Configuration Language (HCL) to provision and configure resources. As a result working with Terraform feels like configuring, and working with Pulumi feels like programming. Also by leveraging programing languages Pulumi gets a lot for free like, linting, modulation, documentation, and it makes asynchronous operations feel natural, allowing for ordering operations and updating resources.

As a developer I took to using Pulumi more naturally, however this may not be the case for everyone. I can see administrators preferring the Terraform style. Also I only spent minutes with the technology setting up a trivial example, it’s possible more extensive use would expose annoyances, or limitations that would cause me to prefer Terraform.

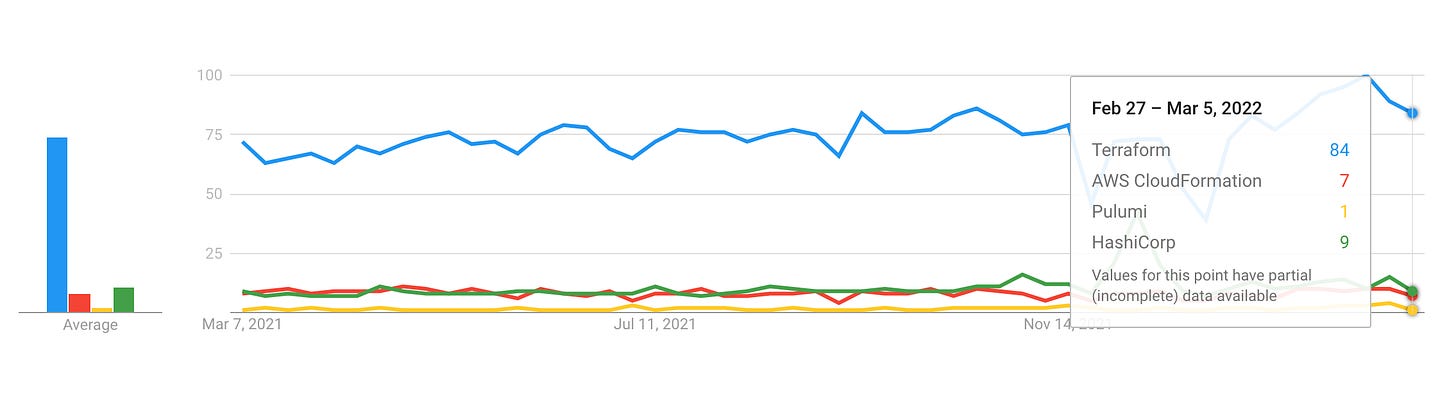

When comparing SEO performance for IaC market Terraform the clear leader.

I evaluated SEO performance of the major competitors. When searching “infrastructure as code” here are the rankings:

Microsoft article that mentions Azure Resource Templates, Terraform, Pulumi, and Ansible

Wikipedia article that mentions CloudFormation, Ansible, and Terraform as tools

Redhat article mentions Ansible

N/A

AWS article that mentions CloudFormation

Blog that mentions Terraform, Pulumi, AWS CloudFormation, Azure Resource Templates

HashiCorp article that mentions Terraform

HashiCorp’s business model is very similar to Elastics, from the previous edition of this newsletter. They offer free and open source self-managed software and charge for premium features, and managed services. This model known as commercial open source software (COSS) is derived from the premise that practitioners are the decision makers for adopting enterprise products. By catering to developers and IT professionals they become the industry standard for multi-cloud provisioning. They generate revenue primarily from subscriptions to premium software, primarily Terraform Enterprise, and HCP pre-built deployments of the products managed in the cloud by HashiCorp.

When are the open source products not enough? As organizations grow in size and complexity they face additional challenges and requirements. Remember my simple example creating an S3 bucket? In this example I had to enter AWS credentials for it to work. Simple enough for when its one person, but what about if you had an entire team or teams sharing the same credentials? You probably want somewhere secured but remote for authorized users to access. This exemplifies one area where a customer might want to upgrade to enterprise, Vault solves this problem and anything else you want to secure, and using it in HCP means everything will work out of the box. Terraform Enterprise, and HCP help organizations scale by offering additional tooling for collaboration, security, standardization, and service level agreements.

Being a subscription based model their revenue is dependent on recurring revenue from existing customers and convincing new customers to upgrade to their paid tiers. If the customer is managing the deployment themselves i.e. Terraform Enterprise (non HCP) they pay for an annual license with additional modules that can be uphold that scale in price with usage. Fully managed offerings can be paid for either annually with a minimum commitment or based on usage. They want to move all contracts to the usage system over time.

“As adoption grows, our marketing organization is focused on building our brand reputation and awareness, and engages with prospective customers through our user conferences”

A major part of their marketing strategy is to engage with target customers via conferences. Taking a look at their event schedule, there are 26 events in February and 29 in March, this doesn’t include non HCP events at other conferences where speakers are talking about their products. A quick search on YouTube, or Google shows thousands of talks, articles and blogs for Terraform.

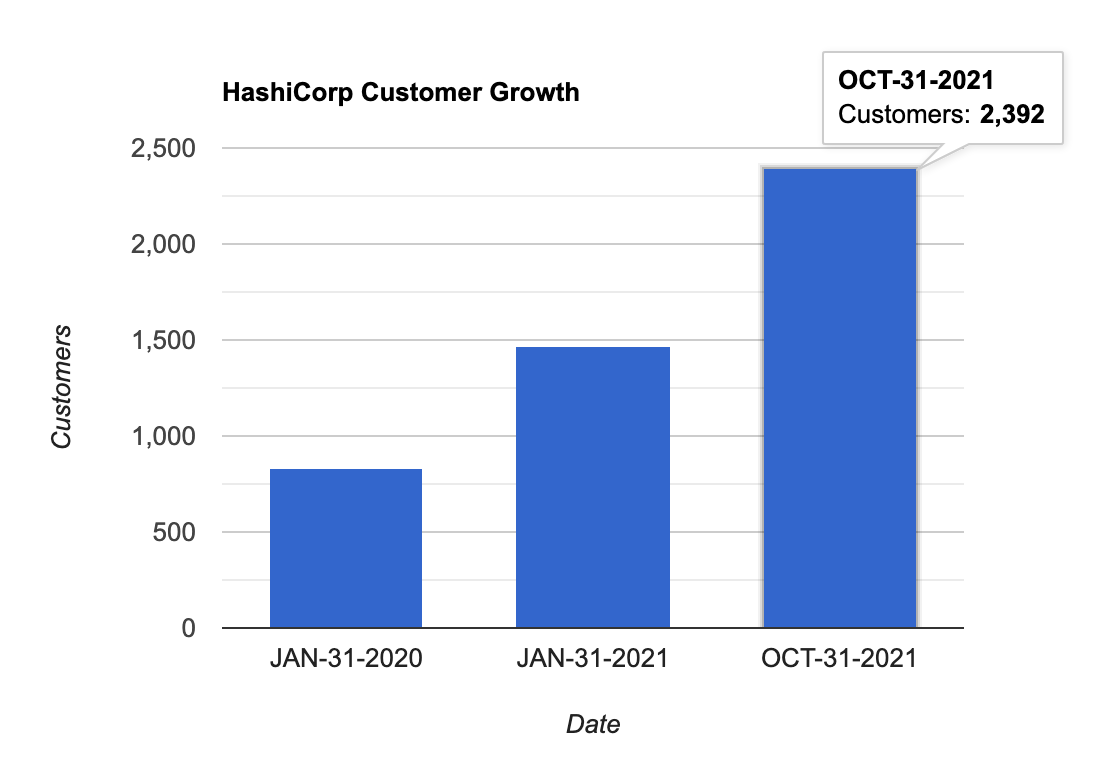

This approach seems to be working evidenced by customer growth over the last 2 years.

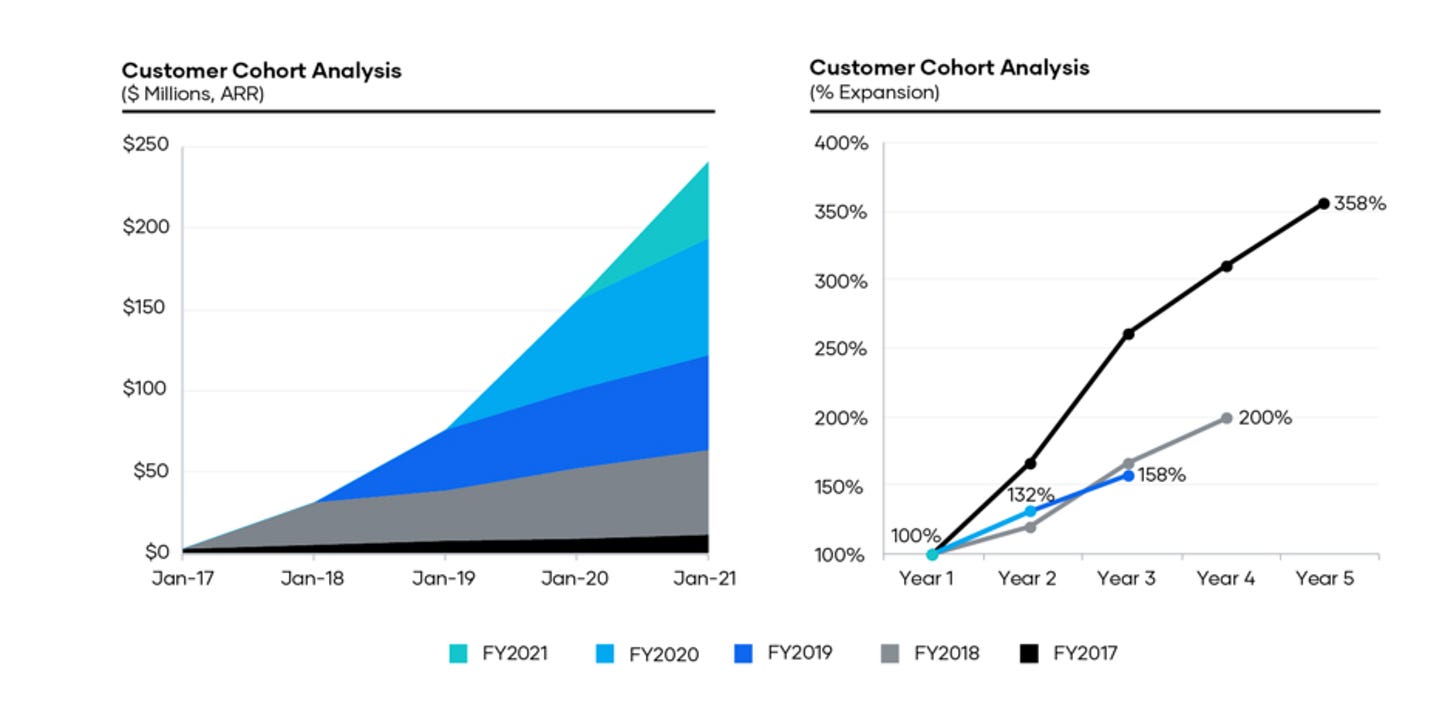

HashiCorp practices an “adopt, land, expand, and extend motion” with is customers. That means that they expand on new customers scaling their usage. They traditionally experience significant expansion with a customer after the initial acquisition. This creates a non linear relation ship with earnings to customers. So as they acquire more customers earnings should grow exponentially. The charts below illustrate this expansion. The one on the left shows growth in total Annual Recurring Revenue (ARR) for a given set of customers acquired in a certain year. The one on the right shows percentage growth in spending from a given set of customers by year.

HashiCorp was first to market in the Multi-Cloud infrastructure management space and has become ubiquitous in the IaC landscape through its open source and community driven business model.

In order for it to defend its market share it needs to keep the lead.

It has to stay in touch with its target users and be first to provide solutions to their problems.

It needs to stay a step ahead of the copy cats, and alternatives like Pulumi. It can do this by continuing to serve the open source community and be responsive to issues and pull requests. This can be monitored via Terraforms GitHub page.

Of course with all cloud companies, the continued trend of adopting and transitioning to the cloud needs to continue. By all available measures this trend is safe, and the market should continue to grow as established companies transition and young companies are choosing the cloud first.

HashiCorp is betting that multi-cloud systems are the future. They need to be right about that to execute on their projections. Currently 75% of organizations are using a multi-cloud model and it makes sense that trend continues, services and pricing are always changing and it helps organizations to arbitrage between them and keep CSPs competitive. I do believe in the long term this trend will continue.

Loyalty from existing customers is important. HashiCorp has a strong foothold and is the clear first answer when people are face with this problem. They have an average Net Dollar Retention Rate (NDRR) of 126% over the last 6 quarter which is excellent.

Cooperation from CSPs. Working with CSPs rather than against them is crucial for HashiCorp’s success. CSPs are an important partner and HashiCorp is dependent on their technologies and API’s being friendly for their products. HashiCorp has recently partnered with Microsoft to provide a zero-trust security platform using Boundary and Azure Active directory. Partnerships like this will expand HashiCorp’s moat and distinguish them from other players in this field.

CEO is an ex-Hortonworks VP, ex-Github VP, and has a trend of building SaaS to sell

Github acquired by Microsoft for $7.5B

Hortonworks merged in all stock deal for 1.305 share-share with Cloudera

CTO is tech oriented, former practitioner and big advocate of open source.

CFO has a background in computer science, with experience in finance at tech companies, and venter capital firms

History of being acquired

Ex IBM finance executive

CMO is ex-Pulumi

Possibly the largest competition in this niche

CRO like the CEO is an ex-VMWare exec

The Founder has gone from CEO to CTO to now what seems to be an advisor and individual contributor, and has a history in university and past employment with the co founder and current CTO.

The culture seems similar to most high growth tech start ups, most employees are proud of the products and success they have found in the market. Technical employees are happy to serve the community through the open source products and find fulfillment in positively impacting developers lives. Most employees feel fairly compensated, and are optimistic about the future.

Also like most tech startups, the workforce is mostly remote and distributed. Consisting of isolated, individual contributors. This is an environment that requires self motivated, talented engineers that can self manage. One risk of environments like this is burnout, many reviews on Glassdoor mention being overworked.

The most concerning reviews come from the sales positions, almost all are unhappy and mention churn, burnout, and lack of compensation. Sales moral appears to be low, I found one Glassdoor review from March 2021 to be insightful.

The highlighted portion describes a crucial dilemma of the open source business model. The open source tech is what drives the initial success and product market fit, but it leaves sales between a rock and hard place.

“Starting with open source enables us to build software in a way that establishes a community where people are engaged and work together to help to solve issues for themselves and for others.” - https://www.hashicorp.com/about

The dilemma of the open source business model is contrary motivations of the open source ethos, and the revenue driven ethos of marketing. The jury is still out on this business model as these style businesses like Elastic, MongoDB and HashiCorp are still young, and dealing with growing pains.

sources: Github, Glassdoor, Linkedin, Reddit, Twitter

Performance

HashiCorp year ended January 31, 2021 - Source

numbers in Millions

Revenue …………………………………………………… ……$211.85

Loss …………………………………………………………… (-$83.515)

Gross Profits ………………………………………………. $170.802

Free Cash Flow ……………………………………………. (-$46.85)

Personal Thoughts

As remote work and mobile computing become the standard, access to unlimited computing power, and storage is becoming expected. This emerging market is huge, and just beginning to take shape as new challenges like Multi-Cloud infrastructure management present themselves. HashiCorp has already found its product market fit in this growing problem space, and now finds itself facing internal growing pains; new fresher competitors, and copy cats.

With the size and potential of this market, and with HashiCorps product recognition and availability through open source, this company has major momentum behind it and its biggest risk is themselves.

I believe that the open source business model can work but the companies implementing them need to commit to either the open source ethos, or maximize revenue ethos. Sometimes shareholder value isn’t everything, exemplified best by Elon Musk, there is value in firm commitment to vision.

As always thanks for reading and happy investing until next time!

"Grade yourself on your temperament. Temperament is the ability to not be swayed by the market." - Warren Buffett